Nonprofits Make This Mistake More Often Than You Think

Jan 23, 2025Today I want to share three real world examples of commonly overlooked mistakes nonprofits make that can lead to severe consequences from the IRS.You might be surprised to learn that some of these have already happened in your nonprofit as well- especially #3!

What is Private Inurement?

Private inurement describes the use of a nonprofit’s resources to benefit a specific individual within the nonprofit personally, rather than being used toward the organization’s stated mission. Sounds a lot like fraud, right? Well, it’s actually much more common than outright fraud, perhaps because it’s not quite as obvious or intentional.

Today, I want to share three of the most common scenarios of private inurement within nonprofits to help you be more equipped to spot it. I also want to demonstrate the need for every nonprofit to document a private inurement policy and regularly train their staff on how to prevent it, since it can jeopardize your tax exempt status or lead to incredibly costly fines. It’s also not a good use of donor funds. As someone who gives to nonprofits, if I learn of an individual within the nonprofit who is benefiting personally from the organization’s resources, it can create a lack of trust for me and for all those that support that mission. So, as nonprofit leaders, it’s important to educate ourselves on this not solely out of fear of non-compliance, but also from the heart of stewarding well all that you’ve been entrusted with.

Scenario #1: Credit Card Benefits

Many organizations use credit cards which can accrue benefits. Don’t get me wrong, there’s nothing wrong with credit card benefits. But, if the credit card benefits are directed toward one individual personally, rather than benefiting the organization, that’s a problem. You see, purchasing power isa actually a resource of the nonprofit. So, if the organization’s purchasing power is used to access a benefit, that benefit should also go back to the organization, not to the individual who simply carries that card.

Real World Example: Airline Miles

If your organization uses a credit card that accrues airline miles that are only available to that one individual, you may want to consider a card with cash back benefits. This directs the benefit back into the organization instead of outside the organization to that one individual, where it could be construed as private inurement. While airline miles typically route to one individual through a specific reward number, cash-back bonuses never expire and don’t have any blackout dates! So, If you like airline perks, use those cash-back bonuses for any mission-related travel.

On a side note, I’ve shared recently about how Ramp is becoming a game-changer for my nonprofit clients. Ramp is a great tool that offers a cash-back reward and lots of other features that nonprofits often need. You can learn more about Ramp on this post.

Scenario #2: Sales Tax Exemption

As a nonprofit, your organization is exempt from paying sales tax. This functions to increase the purchasing power of your organization and allows your resources to go further. But this exemption does not apply to the personal transactions of the nonprofit’s employees.

Real World Example: Tax Free Groceries

Let’s say a member of your team is making a Costco or Sam’s Club run to buy snacks for a youth event, under the organization’s membership which is a tax exempt account. While they’re there, they grab a few personal things for their own household, which they pay for in a separate transaction with their own personal cash. No harm, no foul, right? Wrong! Using the organization’s tax-exempt status to buy anything for an employee’s personal use is private inurement- no matter how separate the transaction is or how it was paid for. By avoiding tax, they are using a nonprofit resource for personal gain.

Scenario #3: Discounts for Nonprofits

Even more common than the first two scenarios is the use of nonprofit discounts for personal employee purchases. These discounts are benefits for nonprofit organizations specifically intended to support their missions and allow their resources to go further.

Real World Example: Employees Buying Personal Computers

I see this over and over again! The manufacturer offers a 10% discount to nonprofits, so the employee asks if they can order their next personal computer through the organization and pay with their own card. Nope. Sorry! That discount was not intended to benefit nonprofit employees. It was intended to benefit nonprofit organizations. This is yet another sneaky example of private inurement that illustrates the need for clearly defined policies and regular, intentional training for your staff, especially department leaders, such as technology in this case.

Creating a private inurement policy is absolutely essential no matter the size of your nonprofit. In fact, this is just one of 7 Essential Policies I cover in much greater detail in my upcoming master course called “The Financially Thriving Nonprofit” In this course, I break down the specific laws around each policy, how to ensure compliance in your nonprofit, what to do if you’ve unknowingly violated rules related to these policies, and how to train your staff to ensure clear and consistent compliance.

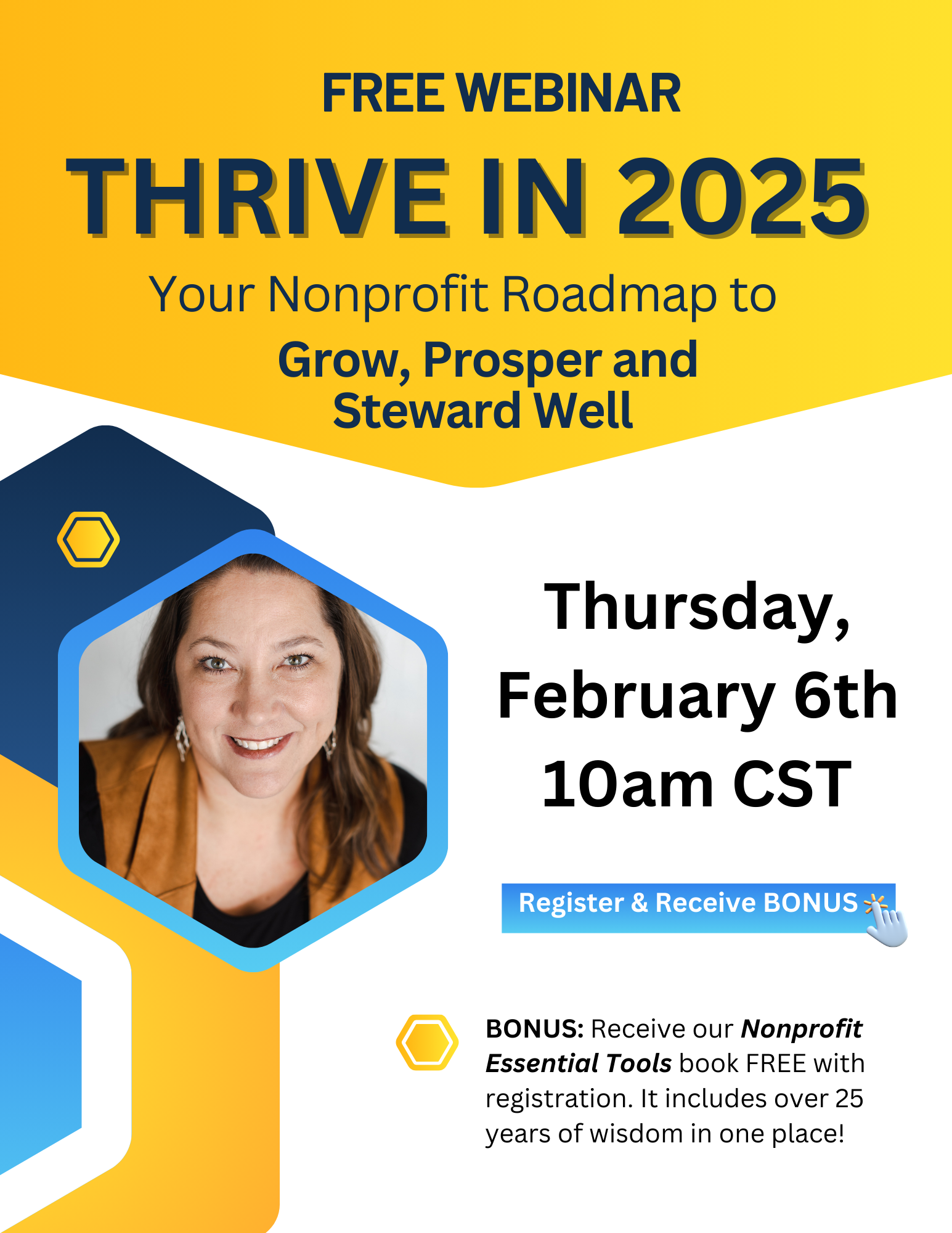

You can hear more about this incredible course in an upcoming live webinar on February 6th. Register for the free webinar HERE or visit my website.

Sign Up to Receive Financial Tips in Your In Box

We hate SPAM. We will never sell your information, for any reason.